“A box without hinges, key, or lid, yet golden treasure inside is hid.” – J.R.R. Tolkien

Blockchain. Smart contracts. Tokenization. Buzzwords of the 21st century with promises of opportunities for golden treasure made accessible to the general population. However, beyond the immense hype built around them, these concepts still remain a mystery to many and unfamiliar territory to all.

Notably, in recent months a big topic that has arisen is the tokenization of funds. It is intended to leverage on blockchain technology to open up opportunities for ordinary retail investors which were previously not available with old, traditional markets or assets. This article seeks to explore what it is, how it works and the benefits of the tokenization of funds.

What is tokenization?

As a starting point, the key question to begin with is what tokenization is. Simply put, tokenization is the process whereby the ownership rights of an asset are converted into purely digital representations of such asset, which can then be subdivided, traded or stored on decentralized ledger technology (loosely referred to as “blockchain” for this article).

A token, in theory, can represent any asset type but typically fall within one of the following two categories: (1) token is native to the blockchain and have no physical presence (e.g., cryptocurrencies); or (2) token is not native to the blockchain and represent some form of real-world asset (e.g., shares). However, while they may represent a real-life asset, it should be noted that the token itself would not be regarded as an asset. Instead, they should be viewed more or less as an equivalent to that of a derivative or an option.

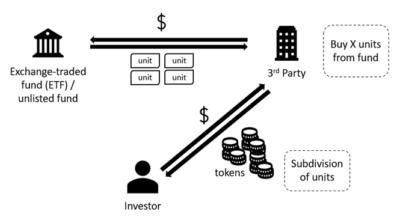

In the case of the tokenization of funds, the tokens fall within the second category as set out above. Tokenization takes old, traditional markets or assets and, using new blockchain technology, flashy new terms and acronyms, repackages them into derivatives or derivative contracts for a new market. By repackaging them into “smaller” bits, tokenization allows for a wide range of assets to become more affordable and liquid, opening up investment opportunities to ordinary retail investors that are otherwise not made available (see diagram below for illustration).

Decentralized Ledger Technology

Decentralized ledger technology is a digital ledger than can record transactions and its details from multiple places at the same time by different people, without the need for any centralized depository to authorise and/or validate any data entries. It allows identical data sets to be shared across various parties on a transparent, real-time basis and cannot be unilaterally amended by any one party, thereby guaranteeing the integrity of the data stored on the decentralized ledger technology. For completeness and clarity, “blockchain”, although used loosely in this article, is a type of decentralized ledger technology wherein transactions are recorded with an immutable cryptographic signature called a hash.

With traditional securities, for any book-entry securities, only the central security depository is empowered to update a central ledger and a single entity is responsible for recording all transaction histories. However, with the use of blockchain technology, all accounting and transfers of tokens are completely decentralized, and its ownership is validated, instead, by the multiple participants in that particular network (i.e., authorization and verification depend on the validation of matching both public and private keys on the blockchain to unlock the corresponding ownership rights). However, with the increased popularity of such tokenization, many jurisdictions have since incorporated various restrictions (e.g., know-your-customer, anti-money laundering, anti-cybercrime) and most tokenization platforms are not completely open anymore.

The use of tokens and blockchain has also enabled transactions to be conducted without the need of an intermediary (e.g., escrow agency). If both the tokens and the cash required for the payment reside on the same blockchain (and are linked to an account on the blockchain), there can be an instant exchange of the two assets (i.e., the tokens and the cash) whereby the transfer of one only occurs if the transfer of the other occurs.

Benefits of Tokenization as an Investment Vehicle

Tokenization allows commercial parties to explore vast “greenfield” areas of opportunity that previously were not available with tradition markets or assets. In some ways, tokenization of funds can be seen to have the potential to revolutionise global financial services.

- Increased Opportunities: While traditional assets (e.g., real estate) are typically defined by their high cost per unit, the tokenization of such traditional assets provides a means to fractionalise ownership of such assets and low the minimum investment threshold, thus allowing ordinary retail investors to trade smaller shares of a private equity position directly in exchange for a fractional share in an investment which would otherwise be unavailable.

- Increased Liquidity: The availability of tokens to small-ticket investors to participate in the market is expected to increase the trading volumes and, together with the market(s) being open 24/7, is expected to bring increased liquidity that cannot be found in traditional markets.

- More Transparency: The use of decentralized ledger technology allows transactions to take place without reliance on a central controlling authority and provides greater transparency and immutability of transactions.

- Improved Compliance: While the financial industry typically spends large amounts of money on compliance, blockchain technology reduces the risk of error and also allows for cheaper and easier means to manage more complicated compliance requirements through programming. It also has the potential to streamline compliance monitoring processes such as know-your-customer or anti-money laundering requirements.

- Higher Efficiency: With the ability of blockchain technology to remove the need for middlemen, this will result in reduced settlement time and also time needed for other processes (e.g., corporate actions).

- Reduced Cost: With automation, transparent and decentralized record-keeping along with reliance on the public internet, this trifecta leads to a significant reduction of cost. In addition, without the need for middlemen, this will further reduce the amount of fees required in such transactions.

- Accessibility: Unlike trading in traditional markets, a digital (or crypto) wallet can be easily accessible online almost instantaneously, thus rendering it more accessible than traditional financial market instruments. This is evidenced by the increasing pickup of such financial investments by new investors in this day and age.

- Encourages Innovation: The use of programmable contracts and decentralized shared ledgers allows for fractionalized traditional assets (e.g., real estate) and other such offerings which were previously unmanageable and unavailable to investors.

That is not to say that the tokenization of funds does not have its downfalls and a key area is that lack of comprehensive regulation in this area.

Regulatory Background in Singapore

In Singapore, offers or issues of digital tokens may be regulated capital markets products under the Securities and Futures Act (Cap. 239) (“SFA”) by the Monetary Authority of Singapore (“MAS”) if they fall within the definition of ‘capital markets products’.

Briefly, “capital markets products” include any securities, units in a collective investment scheme, derivatives contracts and spot foreign exchange contracts for purposes of leveraged foreign exchange trading. In each case, the MAS will examine the structure and characteristics, together with the rights attached to, a digital token in determining if it is a type of capital markets products under the SFA.

If the tokens constitute capital markets products, a person may only make an offer of such tokens in compliance with the requirements under Part XIII of the SFA, which includes the requirements that the offer must be made in or accompanied by a prospectus that is prepared in accordance with the SFA and that is registered with the MAS, unless it falls under one of the exemptions. In addition, the MAS also regulates the intermediaries that facilitate offers or issues of tokens which constitute capital markets products:

- Primary Platform: person who operates a platform on which one or more offerors of tokens may make primary offers or issues of digital tokens may be carrying on business in one or more regulated activities under the SFA and must hold a capital markets services licence for that regulated activity unless otherwise exempted;

- Financial Adviser: person who provides financial advice in respect of any tokens that is an investment product must be authorised to do so in respect of that type of financial advisory service by a financial adviser’s licence under the Financial Advisers Act (Cap. 110), unless otherwise exempted; and

- Trading Platform: person who operates a platform at which tokens are traded may be establishing or operating an organised market, which must be approved by the MAS as an approved exchange or recognised by MAS as a recognised market operator under the SFA unless otherwise exempted.

In addition to these licensing requirements, it should be noted that there may also be anti-money laundering and counter financing of terrorism laws which apply in respect of activities in relation to digital tokens. Under the MAS’ Notice on Prevention of Money Laundering and Countering the Financing of Terrorism, an intermediary conducting one or more of the regulated activities under the SFA will subject to anti-money laundering and counter financing of terrorism requirements which, broadly, include:

- Taking appropriate steps to identify, assess and understand money laundering and terrorism financing risks;

- Developing and implementing policies, procedures and controls to enable the effective management and mitigation of risks that have been identified (e.g., customer due diligence, transaction monitoring);

- Performing enhanced measure if higher money-laundering or terrorism financing risks have been identified; and

- Monitoring the implementation of these policies, procedures and controls.

It should be noted that, even if the tokens do not fall within the MAS’ regulatory purview, it may nonetheless be subject to other anti-money laundering or counter terrorism financing legislation such as the obligation to report suspicious transactions under section 39 of the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act (Cap. 65A), or the prohibition from dealing with or providing financial services to designated individuals and entities pursuant to the Terrorism (Suppression of Financing) Act (Cap. 325).

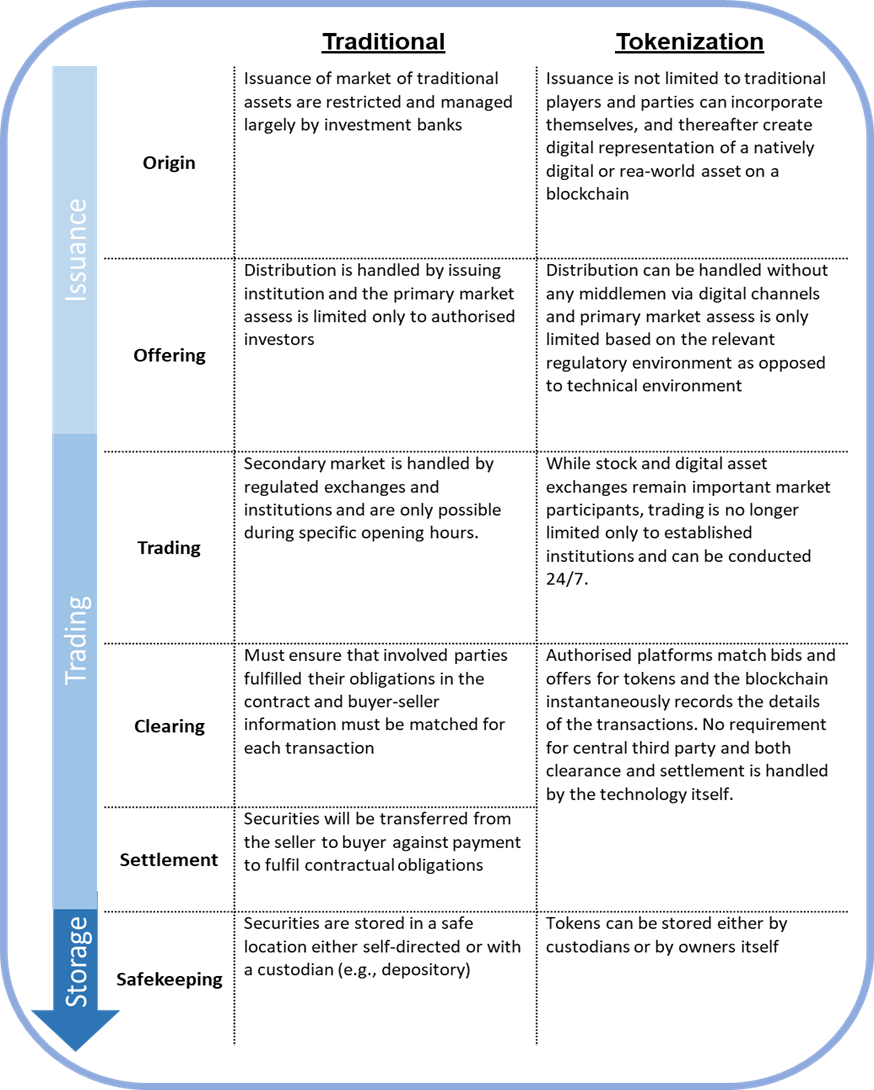

Brief Comparison

Conclusion

Will the tokenization of funds fulfil in its golden promises of golden treasure made accessible to the average retail investor? Having gone through the various aspects of tokenization, this ultimately remains up for debate. While it does sound appealing to open up such opportunities to a greater volume of people, only time will tell if this model of investment will be a sustainable one in the long run.

This article seeks to briefly introduce the tokenization of funds in a summarized and engaging manner and should not be construed as legal advice in any form or manner. For more information on this matter, please feel free to contact Ms Jennifer Chih and Ms Maria Chang.

“The information provided in this page is for general informational purposes only and is not intended to constitute legal advice. We do not warrant its accuracy or completeness or accept any liability for any loss or damage arising from any reliance thereon. While we strive to provide accurate and up-to-date information, the legal landscape is constantly evolving, and the details of any given case may change over time.”