On 14 February 2023, the Deputy Prime Minister and Minister for Finance of Singapore delivered the long-awaited 2023 Budget Statement, which sought to showcase the country’s effort moving forward in “building our capabilities and seizing new opportunities in a new era of global development”.

Of note, amongst the myriad of policies and changes introduced during the 2023 Budget Statement, there were several measures that businesses should note will change and update their obligations as employers, such as the obligation to consider flex-work arrangements, increase in parental leave, and the adjustment of Central Provident Fund (“CPF“) contribution rates.

Correspondingly, businesses will have to adapt their internal policies and procedures with these significant changes in these 2 years until 2024. This Article seeks to provide a brief overview of key changes introduced, and their implications, that employers should note following the delivery of the 2023 Budget Statement.

- Implementation of Tripartite Guidelines on Flexi-Work Arrangements

During the Budget, the Government announced its intention to implement the Tripartite Standard on Flexi-Work Arrangements (which are currently voluntary) as Tripartite Guidelines by 2024. Although this was announced as part of its efforts to “better support parents in managing their work and family commitments”, it should be noted that the implementation of the Tripartite Guidelines on Flexi-Work Arrangements will likely apply to all employees in Singapore.

In effect, what this means is that employers will be required to consider staff requests for such flexi-work arrangements fairly and properly.

This will likely have a significant impact on business operations in Singapore and businesses should take note to familiarize themselves with the current Tripartite Standard on Flexi-Work Arrangements in the meantime and start preparing their own internal flexi-work arrangement policies accordingly.

02. Increased Parental Leave

The Government has long recognized that families “form the bedrock of our society and are the anchors of emotional, social, and financial support for all of us”. In order to provide additional support to working couples, the following changes to parental leave were announced:

a)Government-Paid Paternity Leave: Government-Paid Paternity Leave will now be doubled from 2 weeks to 4 weeks for eligible working fathers of Singaporean children born on or after 1 January 2024. As a starting point, the additional 2 weeks are voluntary, where employers who are ready to grant the additional leave will be reimbursed by the Government. However, the Government further announced its intentions to make this mandatory in due course.

b) Unpaid Infant Care Leave: Unpaid Infant Care Leave for each parent in a child’s first 2 years will be increased from the current 6 days to 12 days annually commencing from 1 January 2024. This increase in Unpaid Infant Care Leave is mandatory and applies for all eligible working parents with Singaporean children aged under 2 years old as at 1 January 2024.

Together, these enhancements will increase parental leave for working couples from the current 22 weeks to up to 26 weeks in their child’s first year.

03. Adjustments to CPF Contribution Rates

In its efforts to enhance retirement adequacy, the Government also announced several adjustments to the CPF contribution rates of individuals in Singapore:

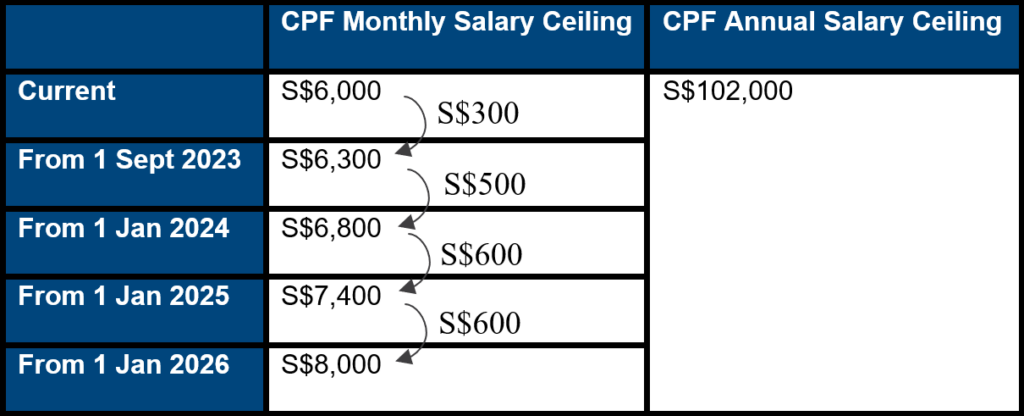

a) Raising CPF monthly salary ceiling: To keep pace with rising salaries, it was announced that the monthly salary ceiling will be raised from S$6,000 to S$8,000 by 2026. This will take place in 4 steps (as shown in the table below) to allow all parties to adjust to the changes, with the first step taking effect from 1 September 2023:

What this means for businesses is that employers (and employees) will have to make more CPF contributions in line with the increased monthly salary ceiling.

b) Increase in Senior Worker CPF contribution rates: In line with the recommendations of the Tripartite Workgroup on Older Workers, both the employer and employee CPF contribution rates for senior workers (i.e., senior Singaporean and Permanent Resident workers aged above 55 to 70) will be gradually increased. This will be implemented in several stages until 2030. The first 2 increases were implemented in 2022 and earlier this year, and the next increase is set to occur on 1 January 2024. Similar to the previous 2 increases, the Government will provide employers with a one-year CPF Transition Offset to alleviate the increase in business cost.

c) Applicability of CPF contributions to Platform Workers (e.g., self-employed delivery workers, private-hire car drivers and taxi drivers): The Government had earlier convened the Advisory Committee on Platform Workers to look into “strengthening protections for Platform Workers, including improving their housing and retirement adequacy”. The recommendations were accepted, one of which was to align the CPF contribution rates of Platform Workers and Platform Companies with those of employees and employers over a period of 5 years.

Accordingly, Platform Workers who are below 30 years old when the changes are implemented will be required to make increased CPF contributions, while those aged 30 and above may opt in during such time. Platform Companies will also be required to pay CPF contributions for these Platform Workers. It is expected that implementation of this will commence from the later part of 2024 at the earliest.

In effect, the adjustments of the CPF contribution rates discussed above provide a somewhat unexpected wage increase for only certain individuals (i.e., those who fall within one of the above categories), and we will likely see a knock-on effect from this in the near future. In any case, in light of all the changes above, businesses must take note of these adjustments and correspondingly plan for these changes by reviewing their existing policies.

Overall, the 2023 Budget Statement has introduced several measures that will change the obligations of employers, with most of the above measures coming into effect by 2024. Businesses are strongly encouraged to prepare for these changes early, for example, by reviewing their existing policies and employment agreements before 2024.

This Article seeks to briefly introduce the key employment changes following the 2023 Budget Statement in a summarized and engaging manner and should not be construed as legal advice in any form or manner. For more information on this matter, please feel free to contact Ms Jennifer Chih and Ms Maria Chang.